Just over a year ago, the passage of the Inflation Reduction Act was considered to be the largest legislative action on climate in the United States. It brought about the Investment Tax Credit (ITC) incentive for independent energy storage, fulfilling one of the biggest demands policymakers have placed on the industry.

Ravi Manghani, director of strategy and market analysis at battery storage system integrator LS Energy Solutions, discusses the impact of the call’s response and the issues that remain for the industry.

What the Inflation Reduction Act Means for Energy Storage

A year has passed since the passage of the Inflation Reduction Act (IRA) on August 16, 2022, and the excitement in the renewable energy industry is palpable.The broader impact of the IRA on decarbonization of the grid and transportation sectors has been discussed at length.

The general consensus remains that the IRA will accelerate the U.S. transition to net zero, but may not be enough to get us all the way there. Some market analyses released shortly after the bill’s passage in the summer of 2022 attributed 20-30% growth in solar, wind, and energy storage installations over the next 10 years.

IRA benefits that will positively impact energy storage growth include the Energy Community Plus, the Qualified Advanced Energy Project Credit (48C) program, direct payments and transferability of the ITC, and of course, the expansion of the wind and solar tax credits. Notably, the energy storage industry has specific incentives up and down the value chain.

Key features of energy storage-specific IRA benefits include:

a) Independent Storage Investment Tax Credit: The industry has taken advantage of the ITC on solar paired projects over the past few years, but this is the first time that independent storage has been eligible for the ITC.While there are multiple tiers of ITC value, it is generally accepted that most projects qualify for at least a 30% tax credit as long as they meet prevailing wage and apprenticeship requirements.This is the first time that independent storage has been eligible for the ITC.

The increased economics of storage projects will undoubtedly lead to more storage orders and deployments. The flip side of this rapid acceleration is that it brings other disadvantages back into focus for renewable energy and storage deployments, none more so than interconnection delays.

b) Advanced Manufacturing Tax Credit 45X: The IRA introduced a manufacturing tax credit for a variety of clean energy technologies, including batteries and modules as well as inverters, although the inverter category does not explicitly list storage inverters. The bill defines an inverter as “an end product suitable for converting direct current from one or more solar modules or certified distributed wind energy systems to alternating current.”

The industry views this limited definition as an oversight rather than an intentional exclusion of energy storage inverters.

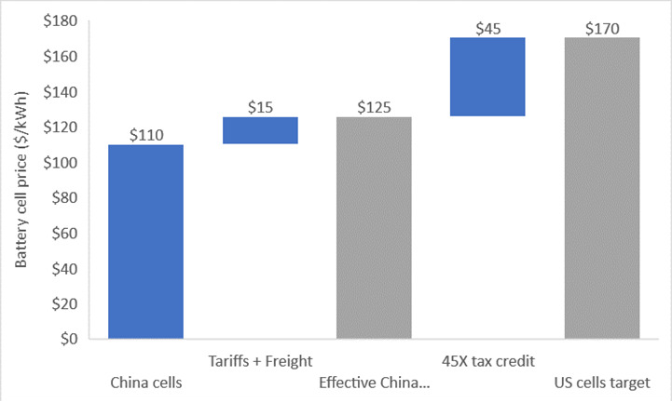

The $45/kWh credit for U.S.-made batteries and modules will undoubtedly close the gap with U.S. products. However, the jury is still out on whether this will be sufficient to make them competitive with Asian products.

For illustrative purposes, if we consider the recent price of Lithium Iron Phosphate (LFP) batteries from China at $100/kWh, and taking into account the Section 301 tariffs on Chinese imports as well as the 45-fold manufacturing credit on U.S.-made batteries, U.S.-made batteries would need to be priced in the $170/kWh range to be competitive in the marketplace.

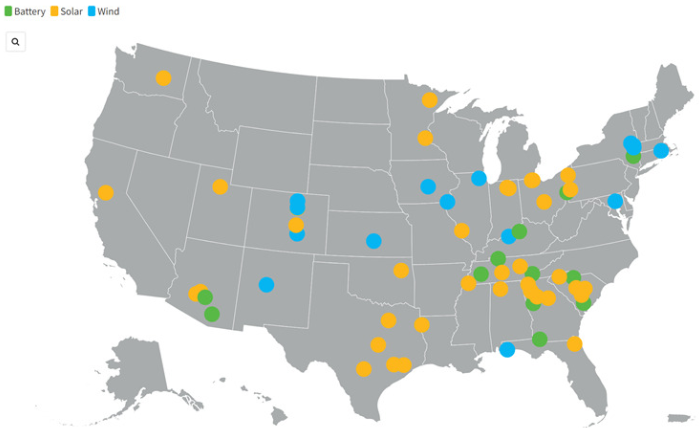

IRA Spurs Increase in New Battery Capacity Announcements. According to the American Council for Clean Energy (ACP), as of August 2023, 14 new battery manufacturing facilities have been announced to serve the energy storage market since the passage of the IRA.

The potential growth in manufacturing capacity should provide more domestic battery options, thereby reducing trade risk and the risk of freight disruption.

The question for all system integrators is: what is the cost premium for domestic supply?

c) Domestic Content Adder: similar to the Energy Community Adder, the ITC has an additional 10% bonus for projects that use 100% U.S.-produced steel or iron, and where at least 40% of the manufactured goods used in those projects are mined, produced, or manufactured in the U.S.

May 2023 Notice of Intent for Domestic Content Raises More Questions

The industry has been waiting with bated breath for clarification on the domestic content requirements (as it has been waiting for guidance on the Advanced Manufacturing Tax Credit). The Treasury Department and the IRS issued a Notice of Intent in May 2023 to provide guidance on the domestic content incentive credit requirements.

The industry’s response to this notice was one of overall disappointment, as the requirements limited the industry’s eligibility for bonuses based on the origin of the cell to all or nothing.

While the categorization of manufactured products (MPs) and their components (MPCs) is problematic, the NOI was written in a way that overexposes system integrators and battery suppliers. The cost basis in the NOI is defined based on the manufacturer’s direct costs.

This structure should normally be interpreted as requiring system integrators to disclose their costs and profit margins. In the industry’s view, this approach violates the premise of “cost to the taxpayer”, which ultimately benefits the taxpayer, not the manufacturer.

In addition, the restrictive domestic content percentage calculations make it nearly impossible to achieve without U.S.-made cells and modules and other related components such as BMS and thermal management.

These difficult domestic content requirements make the notice impossible for the industry, and it is expected that Treasury and the IRS will be receptive to feedback from industry stakeholders. In the meantime, few, if any, projects are entering the construction phase and incorporating the 10% domestic content bonus into their financial modeling.